You’ve prepared your finances for purchasing a home, but are you equipped for the ongoing costs of homeownership? Beyond the initial purchase price, homeownership involves numerous other expenses that aren’t immediately obvious at the time of purchase.

Discussions around buying a home often focus on upfront costs like insurance, closing fees, and inspections. However, when eyeing your next dwelling, it’s crucial to consider the long-term ownership costs.

A home, much like a vehicle, incurs various expenses long after the initial purchase. Planning for these expenses from the outset and during your tenure as a homeowner is essential to avoid financial discomfort.

Beyond the Regular Home Costs

While your regular mortgage payments might cover essential expenses like homeowner’s insurance, property taxes, and possibly homeowners association (HOA) fees, there are additional costs associated with home ownership that you should be prepared for to ensure your property remains in excellent condition.

According to Matt Dunbar, the Senior Vice President of the Southeast Region at Churchill Mortgage in Miami, “Homeowners often face a range of costs that go beyond their mortgage and escrow payments. These can include expenses for home decoration, small-scale remodeling, upkeep, and performance enhancements. Although these expenses can add to a home’s charm, worth, and longevity, they also come with financial considerations. It’s important to factor these costs into your initial budget to maintain a balanced financial situation and to maximize your home’s potential.”

So, how much should you allocate for these additional expenses?

Chris Birk, Vice President of Mortgage Insight at Veterans United Home Loans in Columbia, Missouri, suggests that “allocating around 1% of your home’s value for maintenance each year is a reasonable guideline to follow.” He explains that even in a newly built home, appliances and systems can break down, and there may be a desire or need to make aesthetic or more significant modifications to the home over time.

Ongoing Expenses for Homeowners

Purchasing a home that has undergone extensive renovations does not exempt you from maintenance, improvements, and personalization costs. The financial input required to maintain a fixer-upper differs from that of a well-maintained property. Access to the previous owner’s maintenance records can provide insight into future expenses.

Debra Dobbs, a broker and owner at The Dobbs Group at Compass in Chicago, notes, “The maintenance expenditure should mirror the home’s age, construction quality, and condition. A practical method for managing these costs is to maintain a spreadsheet for home maintenance, allocating a budget for each task.”

Dobbs emphasizes that while updates increase your home’s value and marketability, they shouldn’t overshadow essential maintenance tasks like roof upkeep, gutter cleaning, or HVAC servicing.

Cost Comparison: New vs. Older Homes

Owning a newly constructed home might seem less costly than an older property due to fewer immediate repair needs. However, new homes also come with their unique set of expenses.

Ellen Pitts, a broker and owner of Harmony Realty at Compass in Raleigh, North Carolina, points out, “New homes typically have lower maintenance costs, but unexpected expenses do arise. For instance, maintaining a new lawn or investing in landscaping can be costly.”

Customizing a new home to suit your taste, though not essential for structural integrity, can quickly become expensive. This includes seemingly minor modifications like painting, lighting upgrades, or adding storage solutions. Pitts adds that new homes undergo settling, potentially necessitating repairs covered by the builder’s warranty but still requiring your time and possibly affecting custom finishes.

The Price of Home Improvements

Upgrading your home’s interior is often unavoidable, whether to save on initial costs with a fixer-upper or due to limited market choices. But what are the potential expenses for such upgrades?

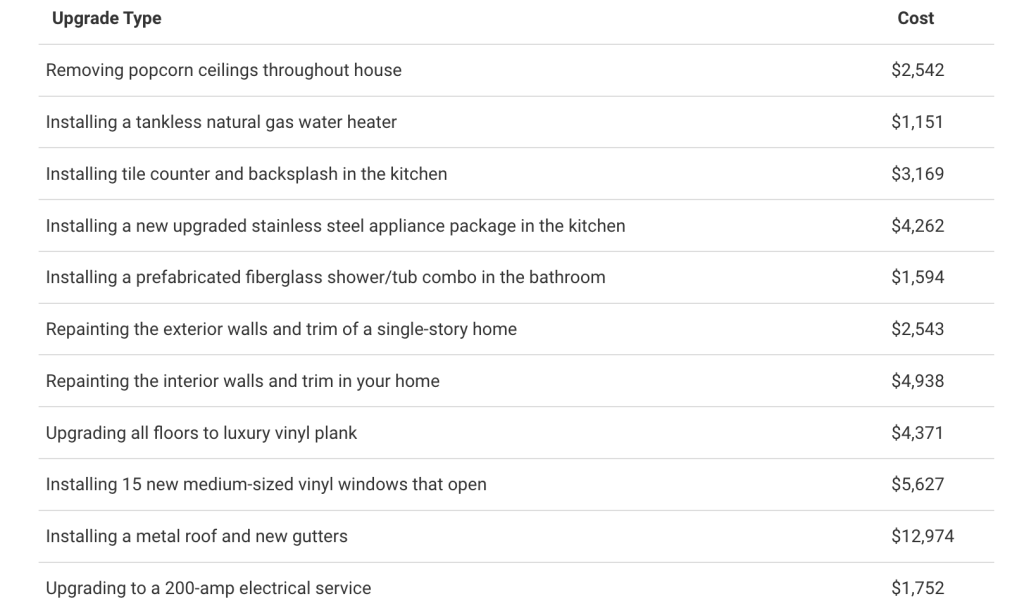

Realtor.com offers a tool for homeowners and potential buyers to estimate the costs of various home improvement projects. For instance, in Springfield, Missouri, the estimated costs for popular renovations in a 1,600-square-foot home include:

Financial Preparedness for Homeownership

Being financially ready to purchase a home doesn’t necessarily mean you’re prepared for the ongoing costs of homeownership. Creating a provisional maintenance budget can aid in assessing whether you’re truly ready to own a home, beyond just acquiring it.

The thought of managing these expenses might seem daunting. However, by opting for a smaller mortgage or reallocating funds from your current budget, you can secure additional money for regular upkeep.

Ellen Pitts suggests, “If your mortgage significantly exceeds your rent, allocate the difference—plus a little extra—toward anticipated maintenance expenses. Successfully saving this amount for six to 12 months without using it indicates your readiness for homeownership.”